property tax assistance program nj

Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Phil Murphy unveiled Thursday.

Tax Collector Elk Township New Jersey

What Are New Jersey Property Tax Relief Programs.

. The Homestead Benefit program provides property tax relief to eligible homeowners. This program will provide up to 35000 in assistance to cover mortgage arrearages delinquent. The Boards other functions include the annual production of the Abstract of Ratables the Equalization Table of Assessments for the purpose of county taxes the supervision of Municipal Tax Assessors and the.

In addition certain VITA Volunteer Income Tax Assistance aides have been trained to help older persons with their tax returns. New Jerseys senior disabled and lower-income homeowners who receive credits on their property tax bills through the Homestead Benefit program would see additional aid under a budget. The Homestead Benefit program provides property tax relief to eligible homeowners.

It was founded in 2000 and has since become a participant in the American Fair Credit Council the US Chamber of Commerce and is accredited by the International Association of Professional Debt Arbitrators. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. Oliver today announced the upcoming launch of the Emergency Rescue Mortgage Assistance Program ERMA administered by the New Jersey Housing and Mortgage Finance Agency NJHMFA.

You also may qualify if you are a surviving spouse or civil union partner. New program set to launch in NJ. Deductions exemptions and abatements.

Ad Apply For Tax Forgiveness and get help through the process. CuraDebt is an organization that deals with debt relief in Hollywood Florida. 2020 92969 or less.

25 2022 817 am. 2021 94178 or less. You are not eligible for a.

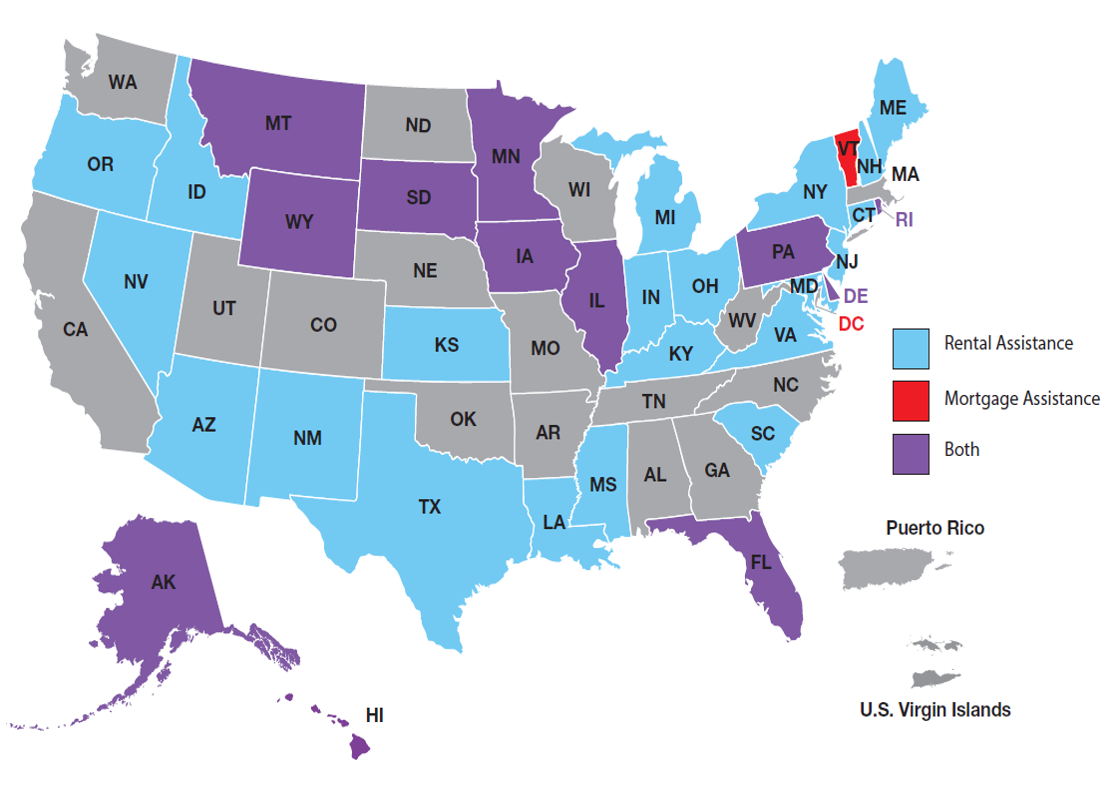

The Emergency Rescue Mortgage Assistance. Emergency Rescue Mortgage Assistance ERMA PROGRAM OVERVIEW. NJ Division of Taxation - NJ Division of Taxation - Senior Freeze Property Tax Reimbursement.

If its approved by fellow Democrats who. NJ Mortgage Property Tax Relief Program Coming Amid COVID Emergency Rescue Mortgage Assistance program will give up to 35000 to those who have. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

CuraDebt is a debt relief company from Hollywood Florida. Helping New Jersey Families. This program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence.

Homestead Benefit Program. About the Company New Jersey Property Tax Relief Programs. Helping New Jersey Families.

TRENTON Governor Philip D. All property tax relief program information provided here is based on current law and is subject to change. The Mercer County Board of Taxations primary responsibility is the certification of property tax assessments.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. Ad Get Assistance for Rent Utilities Education Housing and More. Senior Freeze Property Tax Reimbursement Information Line - 1-800-882-6597 within NJ NY PA DE and MD.

To qualify for assistance a homeowner must. Up to 35000 per household for expenses which may include. We have three Programs to Assist New Jersey Residents.

Get a Free Consultation. The New Jersey Homestead Benefit Program provides property tax relief to eligible homeowners in the form of a property tax credit that the state pays to municipalities on. Get Funding For Rent Utilities Housing Education Disability and More.

It was established in 2000 and is an active participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators. Long-awaited help is coming for homeowners who have fallen behind on their mortgages property taxes and other expenses. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid starting Feb.

As one of the most expensive states to live in NJ citizens may need help paying property taxes to keep up with the high cost of living. United Way of Hunterdon County is providing free assistance to those wishing to file for the NJ Senior FreezeProperty Tax. About the Company Nj Property Tax Relief Programs.

Mortgage payments including principal interest taxes and homeowners insurance. Mega Millions 128 billion winning ticket sold. With the state government awash in tax revenue state Senate President Nicholas Scutari D-Union and Assembly Speaker Craig Coughlin D-Middlesex joined Murphy to outline upgrades to the program.

See Income Limits History for past years income limit amounts. Ad Explore Our Recommendations for 2022s Top Tax Relief Companies. FAIR LAWN Building on his commitment to making New Jersey stronger fairer and more affordable Governor Phil Murphy today unveiled the ANCHOR Property Tax Relief Program a new initiative that will distribute 900 million in property tax relief to nearly 18 million homeowners and renters across the state during Fiscal Year 2023 FY2023.

Your total annual income combined if you were married or in a civil union and lived in the same home was. Through the Tax Counseling for the Elderly TCE program IRS-trained volunteers assist individuals age 60 and over with their tax returns at various neighborhood locations. Best Tax Relief Brands.

Click Now Compare 2022s 10 Best Tax Relief Companies. We do not help businesses and we do not offer grant assistance to second homes or investments properties. New Jersey homeowners struggling to pay their mortgage or property taxes can apply for up to 35000 in aid when the state opens its application portal on Feb.

At New Jersey Tax Assitance we help New Jersey residents who are behind on their New Jersey property taxes. One way of saving a penny or two is by applying for NJ property tax relief programs such as. Municipal or property tax liens.

All property tax relief program information provided here is based on current law and is subject to change.

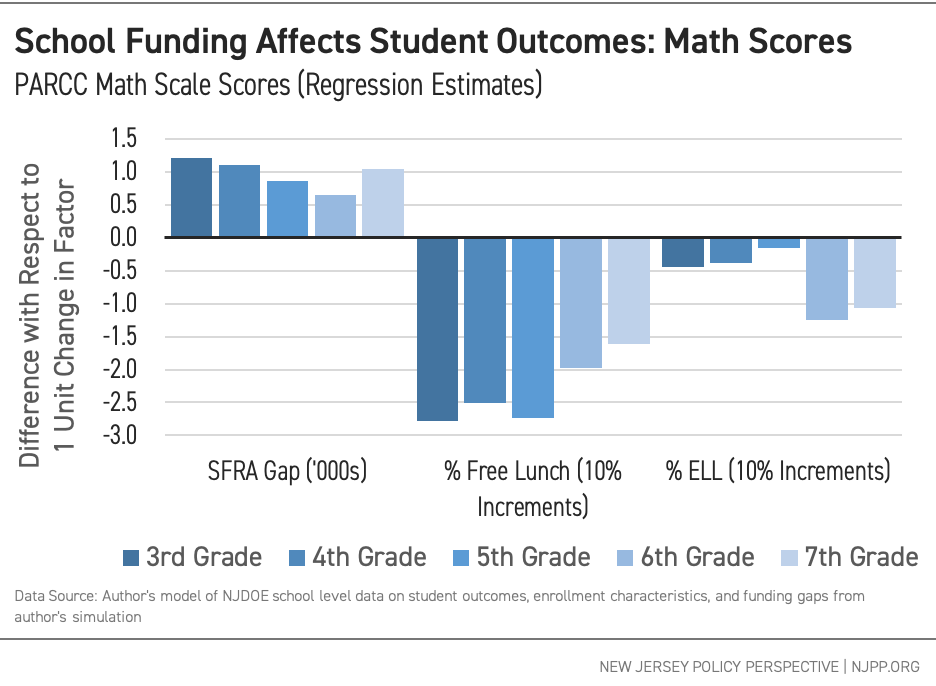

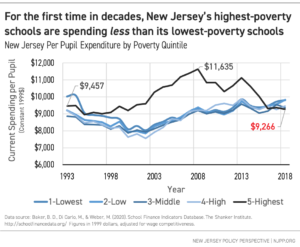

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

Latino Coalition Of New Jersey Home Facebook

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global

New Jersey Mortgage Calculator Smartasset

The Official Website Of The Township Of Belleville Nj Tax Collector

If You Live In New Jersey These Tax Rules Might Help You Save On Taxes

The Official Website Of The Township Of Belleville Nj Tax Collector

The Official Website Of The Township Of Belleville Nj Tax Collector

Help For Businesses Paterson New Jersey

Gov Murphy Signs Nj 2022 Budget With 500 Rebate Checks Holmdel Nj Patch

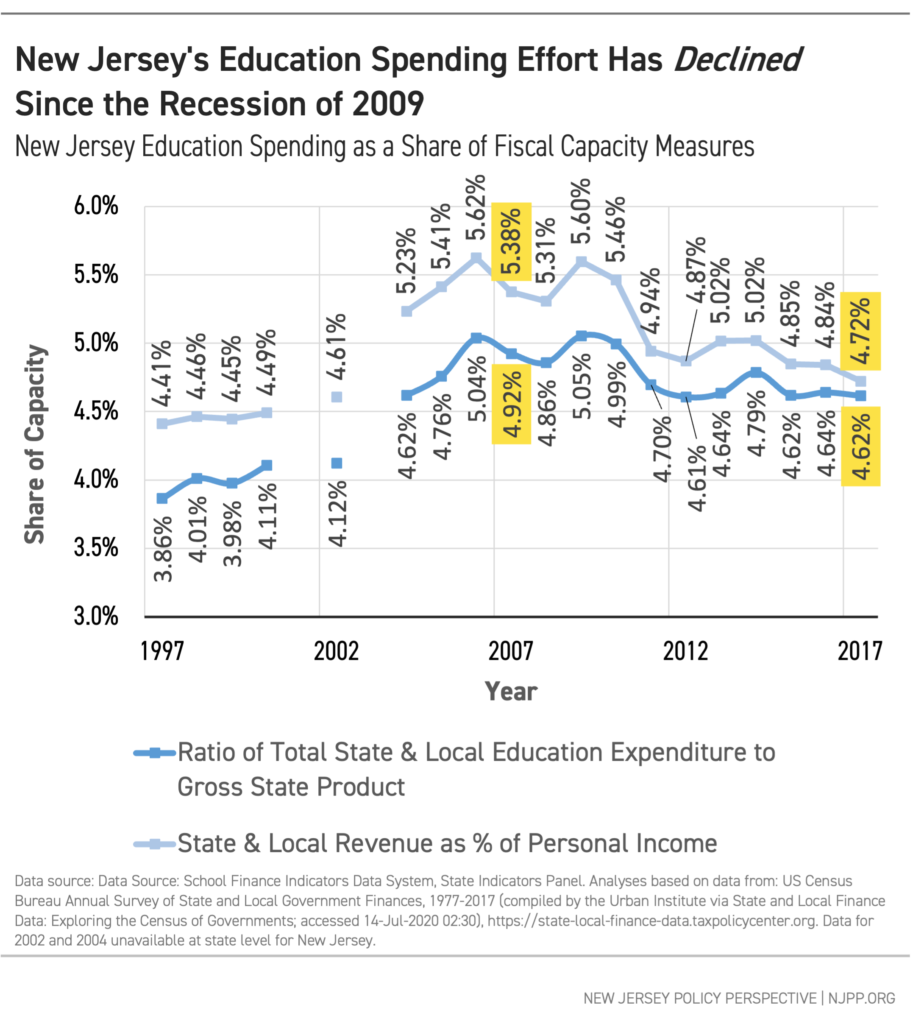

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

State Hfa Emergency Housing Assistance 2020 Programs Ncsha

School Funding In New Jersey A Fair Future For All New Jersey Policy Perspective

Economic Incentive Programs Trenton Nj

The Official Website Of The Township Of Belleville Nj Tax Collector

Tax Collector Borough Of Point Pleasant

Township Of Teaneck New Jersey Covid19

Property Tax Relief How It Works Credit Karma

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet